Video: Charge interest to your Accounts Receivable

Receivables - View, Add and Edit Transactions

You can apply interest charges to all clients flagged to have interest charged to them. Depending on your settings, interest charges will be applied after the due date, or every 30, 60, or 90+ days. For example, if you select 30 days, interest will be charged on any debt that is over 30 days overdue.

The interest being calculated in receivables is compound interest.

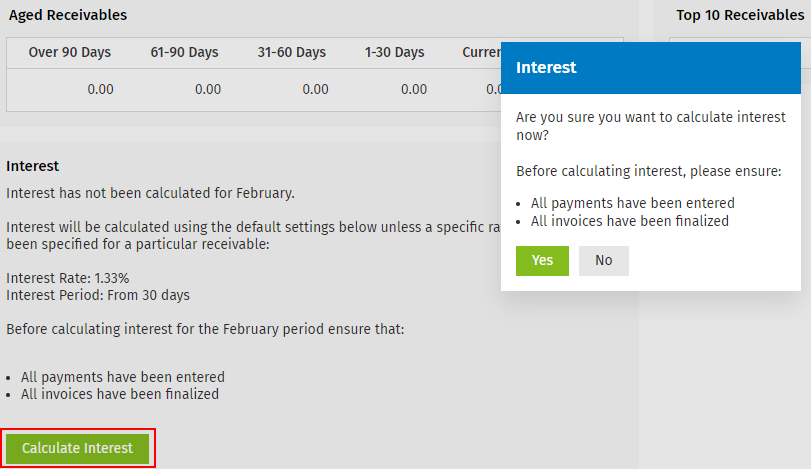

When you charge interest it will be applied at the rate specified under Settings > Practice Management > General Settings > Accounts Receivable tab, unless a custom rate for a client has been entered. Before you apply interest, ensure that all your payments have been entered (so you do not charge interest on amounts that are no longer due), and all the invoices that you want to be considered in the interest calculations have been finalized.

Once interest charges are applied the Calculate Interest button will not be available until the start of the next month.

- Click Time and Billing > Accounts Receivable.

- Click Calculate Interest in the Interest panel.

- Click Yes.

- Click OK.

When you run your monthly interest calculation, an interest transaction is created for all relevant clients that are flagged for interest calculation. You can view the interest transaction in their receivables area.

The next time you enter a payment, the interest transaction will be listed as an outstanding balance, and you can allocate the payment to the interest.